Texas Rule 506 Notice Filings: Exact Steps, Timing, and Checklists

Loading the Elevenlabs Text to Speech AudioNative Player...

Scope: This guide assumes you’re raising under Rule 506(b) or Rule 506(c) and have (or expect) Texas purchasers.

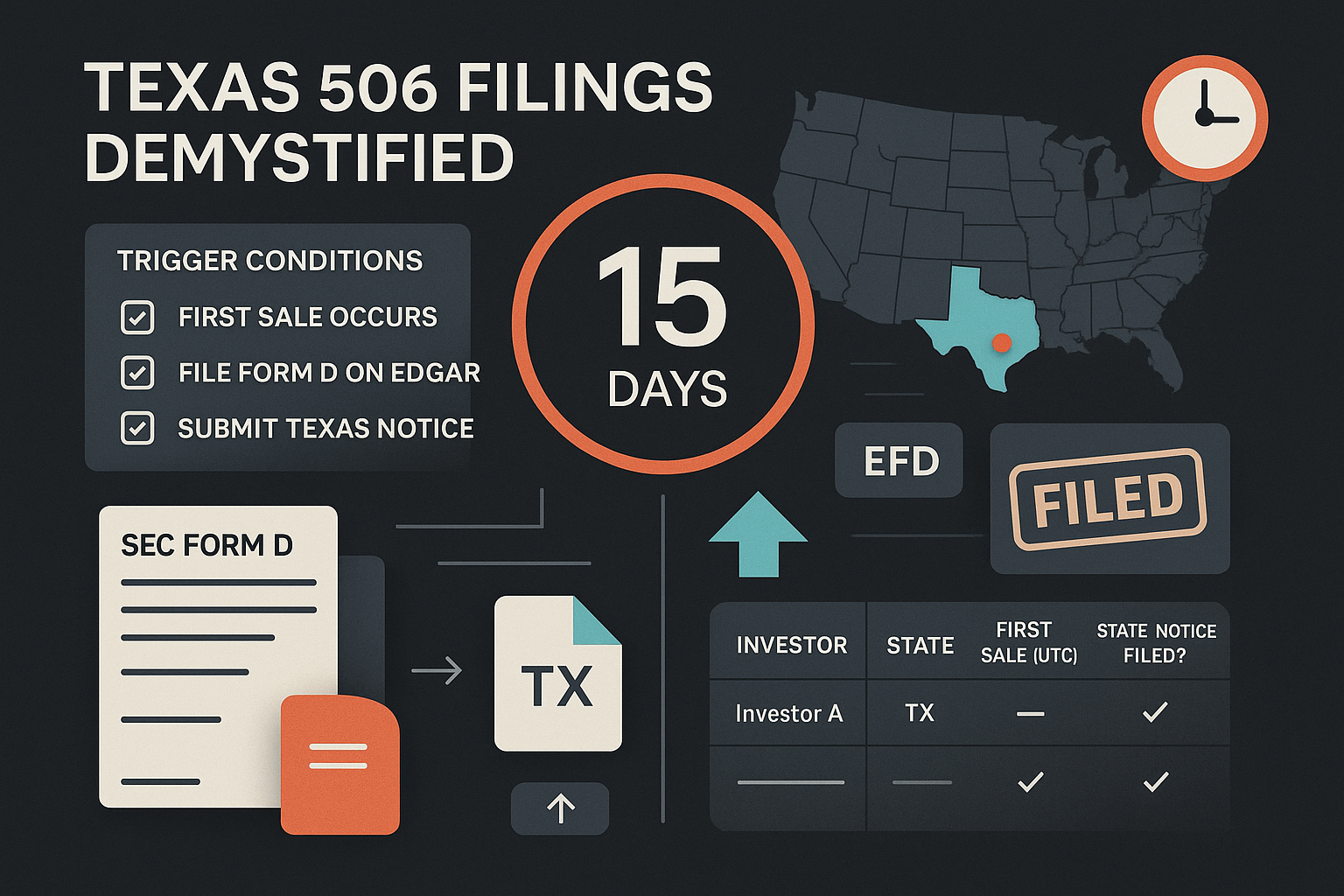

What triggers a Texas notice—and when

- Federal trigger: File SEC Form D within 15 calendar days after the first sale.

- Texas trigger: When you sell to a Texas resident in a Rule 506 offering, Texas requires a state notice. Texas keys timing to the first sale of securities in Texas.

- If the due date lands on a weekend/holiday, file by the next business day.

- Always confirm current procedures/fees on the TSSB site; do not hardcode dollar amounts.

Define “first sale”: The date/time your company becomes irrevocably committed with a purchaser (e.g., countersigned subscription + funds, or other binding commitment).

What you submit (Texas)

- Copy of the SEC Form D you filed with the SEC

- Issuer and contact details (captured in EFD workflow)

- Any Texas‑specific attestations requested in EFD

- Payment of the Texas notice fee per current TSSB schedule (verify before paying)

How you submit (process)

- File Form D on EDGAR within 15 days of the first sale.

- Log into NASAA’s EFD and select Texas for your Rule 506 notice.

- Upload/confirm required items and pay the applicable fee.

- Save submission receipts and payment confirmations with your offering records.

Where to file:

- EFD: https://www.efdnasaa.org

- TSSB (rules, fees, and instructions): https://www.ssb.texas.gov

Amendments & follow‑ups

- Amend Texas contemporaneously with any SEC Form D amendment (e.g., material changes, corrections).

- If details change in a way that affects fee calculations or disclosure, follow TSSB guidance (including “excess sales” scenarios).

- Keep your state matrix current (who bought, where they reside, first‑sale dates, filing confirmations).

Texas Rule 506 Notice — Master Checklist

A) Before the first offer

- Choose your exemption: 506(b) (no general solicitation) vs 506(c) (general solicitation + verification).

- Tighten your documents: subscription, investor questionnaire, cap table summary, financials, tailored risk factors.

- Plan communications:

- 506(b): private, relationship‑based outreach only.

- 506(c): public messaging allowed; set up accredited‑status verification workflow (third‑party letters or documentation).

- Create a state‑by‑state tracker: investor name, state, first‑sale date, notice status, confirmation number.

B) Day 0 — First sale occurs

- Record the exact date/time of the first binding commitment.

- Update the tracker with purchaser state and sale date (note Texas vs. other states).

C) Within 15 calendar days after the first sale

- File SEC Form D (EDGAR).

- File the Texas Rule 506 notice via EFD if any purchaser is a Texas resident; pay the fee (verify current amount).

- Calendar/file notices for other purchaser states as required (many accept EFD).

- Save receipts and payment confirmations.

D) During the raise (rolling closes)

- Maintain disclosure integrity (update changes promptly).

- Track accreditation:

- 506(b): keep signed questionnaires/notes.

- 506(c): take and document reasonable steps to verify (self‑certification is not enough).

- Messaging guardrails:

- 506(b): avoid general solicitation.

- 506(c): ensure public statements match disclosures; Texas anti‑fraud applies.

- Each time a Texas purchaser invests, confirm that a Texas notice is on file (amend if details have materially changed).

E) After closing

- Consider whether a Form D amendment is needed (e.g., to correct errors or reflect material changes).

- If you amend federally, amend Texas via EFD as applicable.

- Retain records: executed subs, questionnaires, 506(c) verification files, notices, receipts, board approvals, comms logs.

State Matrix (template)

| Investor | State | First Sale (UTC) | SEC Form D Filed? | State Notice Filed? | Confirmation # | Notes |

|---|---|---|---|---|---|---|

| Investor A | TX | YYYY‑MM‑DD hh:mm | ✅ | ✅ | TX‑EFD‑##### | 506(c) verified on YYYY‑MM‑DD |

| Investor B | CA | YYYY‑MM‑DD hh:mm | ✅ | ✅ | CA‑EFD‑##### | … |

Pro tips (hard‑won details)

- Assign a single owner for all filings.

- Start a countdown from Day 0; avoid last‑minute EDGAR/EFD hiccups.

- If your round will likely include Texas investors later, set a reminder to file as soon as the first Texas sale posts.

- Do not hardcode fees; verify on TSSB before paying.

Filing FAQs (Texas + Rule 506)

Do I need a Texas filing if I used 506(b) or 506(c) and sold to a Texas resident?

Yes. NSMIA preempts registration, not state notice + fees + anti‑fraud.

What if I started private (506(b)) and then went public (506(c))?

Manage sequencing carefully and see integration rules (Rule 152). Keep funnels separate and document timing.

Where do I actually file?

EFD for Texas (https://www.efdnasaa.org). Confirm process/fees on TSSB (https://www.ssb.texas.gov).

References & Sources

- NASAA EFD: https://www.efdnasaa.org

- Texas State Securities Board (TSSB): https://www.ssb.texas.gov

- Reg D (17 CFR Part 230): https://www.ecfr.gov/current/title-17/chapter-II/part-230

- Rule 152 (integration): https://www.ecfr.gov/current/title-17/section-230.152

Feedback & Corrections

See our Corrections Policy and email [email protected] with updates or suggestions.

Disclaimer

Informational only; not legal advice. Rules, forms, and fees change—verify current Texas requirements with the TSSB before filing.