Issued vs. Outstanding vs. Fully Diluted: The Plain-English Guide Every Founder Needs

Founders, early employees, and in-house counsel are often asked for “issued,” “outstanding,” and “fully diluted” share counts — and mixing these up can misprice equity grants, break promises to hires, and create expensive cap-table cleanups before a financing. This short, practical guide explains those terms in plain English, uses a single running example, and gives concrete math, governance steps, and a checklist so you can present defensible numbers to investors and candidates. For a deeper dive on how many shares to authorize or issue, see our guide How many shares to issue, and for mechanics of fully diluted calculations see Understanding fully diluted shares.

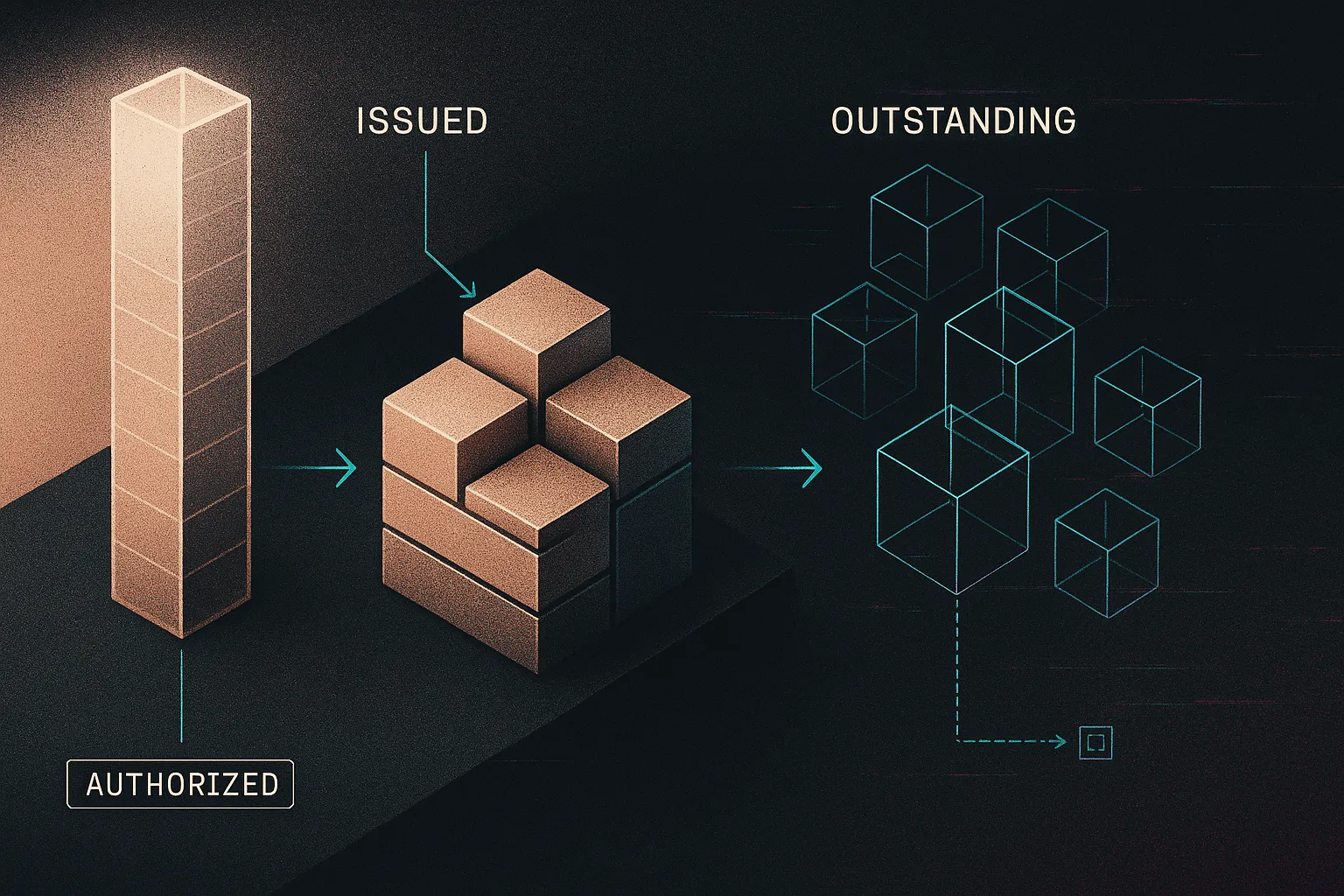

Start With the Core Definitions

Issued shares are every share the company has granted or sold (including any later repurchases). Outstanding shares are the subset of issued shares currently held by stockholders — effectively issued minus any treasury shares; unexercised options are usually not outstanding.

- Authorized: the charter maximum for how many shares you may create (see how many shares to authorize).

- Issued: shares actually granted or sold to people (this count includes shares the company later holds as treasury).

- Outstanding: issued shares that remain held by shareholders (issued − treasury).

Running example: 10,000,000 authorized; 3,000,000 to founders + 1,000,000 to an early investor = 4,000,000 issued; 1,000,000 option pool (unissued); 200,000 later repurchased from founders into treasury → founders now hold 2,800,000; outstanding = 4,000,000 − 200,000 = 3,800,000.

Where these live: authorized = certificate of incorporation; issued/outstanding appear in your stock ledger and cap table (your single source of truth).

Memory: Authorized = ceiling; Issued = what you actually gave out; Outstanding = what people currently hold.

How These Share Counts Show Up in Your Cap Table

Your cap table is the single-source snapshot of who owns what. Include columns for holder, security type, shares, % of outstanding, and % fully diluted. Using the running example: Authorized 10,000,000; Issued 4,000,000; Treasury 200,000 → Outstanding = 3,800,000; Fully diluted = 3,800,000 + 1,000,000 option pool = 4,800,000.

- Founder A (Common) — 1,600,000 — 42.11% of outstanding / 33.33% fully diluted

- Founder B (Common) — 1,200,000 — 31.58% of outstanding / 25.00% fully diluted

- Early investor (Preferred) — 1,000,000 — 26.32% of outstanding / 20.83% fully diluted

- Option pool (reserved, unissued) — 1,000,000 — 0.00% of outstanding / 20.83% fully diluted

- Treasury (company) — 200,000 — not counted in outstanding or fully diluted

Quick clarity: “% of issued” uses issued shares as the denominator; “% of outstanding” uses outstanding; “% fully diluted” uses the fully diluted denominator (what investors typically ask for). Don’t promise “5%” without naming the denominator and cap-table date. For more on the fully diluted denominator, see Demystifying Fully Diluted Shares. Sanity check: divide the holder’s shares by the stated denominator and reconcile the cap table to your stock ledger and charter.

Deciding How Many Shares to Authorize vs Actually Issue Now

Most startups authorize a round, large number (e.g., 10M) but issue far fewer at formation so they can grant stock and expand an option pool without amending the charter. For a deeper walkthrough see our guide on how many shares to issue.

- Pick an authorized ceiling with counsel (common choices: 10M–20M).

- Issue only what you need now — founders commonly take 3–6M total rather than the full authorized amount.

- Reserve an option pool (1–2M) and leave the remainder unissued for future hires/rounds.

Numeric example: 10,000,000 authorized; issue 4,000,000 now; reserve 1,000,000 option pool; 5,000,000 left unissued.

Legal/process: share issuances need board approval and formal docs; increasing authorized shares requires a charter amendment and stockholder approval — see our post on increasing authorized shares for the mechanics.

Understanding Treasury Shares, Option Pools, and Fully Diluted Ownership

Treasury shares are shares the company issued and later repurchased or retains; they are not counted as outstanding. Option pool refers to authorized but unissued shares reserved for equity incentives. Fully diluted equals current outstanding shares plus all shares that would exist if every option, warrant, or convertible security converted or was exercised.

Running example: issued = 4,000,000; treasury = 200,000 → outstanding = 3,800,000. Add 1,000,000 option pool → fully diluted = 4,800,000. Founders' 2,800,000 = 2,800,000/3,800,000 = 73.68% outstanding, but 2,800,000/4,800,000 = 58.33% fully diluted.

Investors typically focus on fully-diluted post‑money ownership; employees often expect their % on a fully-diluted basis. Be explicit about which denominator you're using and the cap-table date — and see our deeper guide to the math in Demystifying Fully Diluted Shares.

Modeling Dilution: What Happens When You Raise a Round

Start: outstanding = 3,800,000; fully diluted = 4,800,000 (1,000,000 option pool).

Investor buys $2M at an $8M pre‑money valuation (fully diluted). Price/share = 8,000,000 / 4,800,000 = $1.6667. New shares = 2,000,000 / 1.6667 = 1,200,000.

Post‑close: outstanding = 3,800,000 + 1,200,000 = 5,000,000; fully diluted = 5,000,000 + 1,000,000 = 6,000,000.

Quick ownership math: Founders 2,800,000 = 56% outstanding / 46.67% FD; early investor 1,000,000 = 20% / 16.67%; new investor 1,200,000 = 24% / 20%.

If the investor requires enlarging the option pool pre‑money, the pre‑money denominator rises and founders absorb extra dilution — always confirm whether the term sheet uses outstanding or fully‑diluted shares (see Demystifying Fully Diluted Shares) and model scenarios in your cap‑table tool with counsel.

Common Mistakes Founders Make With Issued and Outstanding Shares

- Treating authorized as issued — fix: use the charter for authorized; compute ownership from outstanding.

- Promising percentages without a denominator — fix: specify “of outstanding” or “of diluted.”

- Issuing stock informally — fix: get board approval and written docs; file 83(b) if needed.

- Not tracking repurchases/cancellations — fix: reconcile your cap table to the stock ledger after any repurchase.

- Failing to update the option pool or cap table — fix: update immediately and model the diluted impact.

Mini case: a startup double‑promised equity to contractor and employee because no one checked outstanding; fix: cancel informal offers, record proper grants, and reconcile with counsel.

Fix early — pre‑seed is far cheaper. Bring counsel before a priced round; see our guide on how many shares to issue.

Legal and Governance Steps Behind the Numbers

Who can issue shares: the board (and sometimes stockholders for major actions). Authorized shares are set in the certificate of incorporation; changing them needs shareholder approval and a charter amendment filed with the state (usually Delaware). Treasury shares arise from repurchases, forfeitures, or cancellations and must be recorded separately.

Documentation you should track: stock purchase agreements, board resolutions/consents, option grant paperwork, an up‑to‑date stock ledger or electronic record, and 83(b) election receipts where relevant.

Why hygiene matters: investors will reconcile your charter, ledgers, and cap table — mismatches slow financings or M&A. Quick checklist: current authorized number; who was issued shares and when; current outstanding; option pool size; board approvals/consents; filed 83(b)s. For mechanics and modeling, see our guides How Many Shares Should You Authorize and Demystifying Fully Diluted Shares. A lawyer‑validated cap table and charter are worth the upfront cost.

FAQ: Quick Answers to Issued vs Outstanding Share Questions

- What is the difference between issued and outstanding shares?

Issued shares are all shares a company has ever granted or sold. Outstanding shares are the subset currently held by shareholders (issued minus any treasury shares). For a clear running example, see the core definitions section of this guide. - Are authorized shares the same as outstanding shares?

No. Authorized shares are the maximum number allowed by your charter, while outstanding shares are the number currently held by investors and employees. Your certificate of incorporation records the authorized amount; for practical drafting tips, see our article on how many shares to issue (How Many Shares Should My Startup Issue?). - Do options count as outstanding shares?

Not until they are exercised. Options and other convertible instruments are included in the fully diluted count because they can become outstanding shares, which is important when modeling investor ownership and dilution; see the section on dilution scenarios for examples. - How many shares should my startup authorize vs issue?

A common practice is to authorize a round number (for example, 10,000,000) but initially issue only what you need to preserve flexibility and minimize administrative friction. For practical recommendations and sample cap table entries, refer to our detailed post on share counts and cap table setup (How Many Shares to Authorize vs Issue). - Can a company have issued shares that are not outstanding?

Yes. Shares that the company has repurchased or holds in treasury remain issued but are not treated as outstanding until reissued or retired. See the treasury shares subsection for how these affect voting and dividend calculations. - Which number do investors use to calculate ownership: issued, outstanding, or fully diluted?

Investors typically look at the fully diluted post-money denominator because it reflects the effect of all convertible securities and option pools. Always confirm the exact denominator and the cap table date when discussing ownership percentages to avoid misunderstandings.

For additional context and worked examples, visit our related posts and resources on the Promise Legal blog.

Related: Sample Cap Table Examples and Cap Table Basics.

Actionable Next Steps

- Pull your certificate of incorporation and confirm the authorized share count — see How Many Shares Should You Authorize for guidance.

- Reconcile your cap table to show authorized, issued, outstanding, and fully diluted, and match those numbers to your stock ledger and charter.

- Standardize equity offers: state both the number of shares and the % using a specific fully‑diluted denominator and cap‑table date (don’t promise “2%” without a denominator).

- Centralize the cap table in one source of truth (cap‑table tool or lawyer‑validated ledger) and update it after every grant, exercise, repurchase, or cancellation.

- Schedule a legal review before your next financing or major option program — Promise Legal can help with cleanup, charter amendments, and compliant grant documentation: Featured Services.

Getting these basics right early reduces risk, protects founder ownership, and makes fundraising and diligence far smoother.