How to Set Up a Series LLC in Texas for Startups and Businesses

A Series Limited Liability Company offers a flexible business structure that is particularly appealing to startups and businesses managing multiple projects, investments, or diversified business lines. In Texas, a state renowned for its pro-business climate and clear regulatory framework, establishing a Series LLC could be a dynamic strategy to both seize opportunities and mitigate risks. In this comprehensive guide, we'll explore what a Series LLC is, the detailed process for setting one up in Texas, and the indispensable role of legal professionals in navigating the complex landscape of formation and compliance matters.

1. Introduction to Setting Up a Series LLC in Texas for Startups and Businesses

Starting a business always involves weighing risk vs. Reward, especially when your venture’s success depends on dynamic innovation and diversification. A Series LLC is a unique type of business entity that combines the benefits of a traditional LLC with added flexibility to structure your operations into separate, legally distinct series under one umbrella. This sets up the possibility of segregating different assets, projects and liabilities, thereby providing peace of mind and risk management without incurring the administrative burden of forming multiple LLCs.

In Texas, the advantages of a Series LLC are heightened by the state’s business-friendly policies. The environment, characterized by low taxes, minimal regulatory constraints, and robust support for innovation, especially makes Texas one of the top states for business. This article will guide you step-by-step on how to form your Series LLC and explain why consulting with a dedicated lawyer can make all the difference.

2. What is a Series LLC?

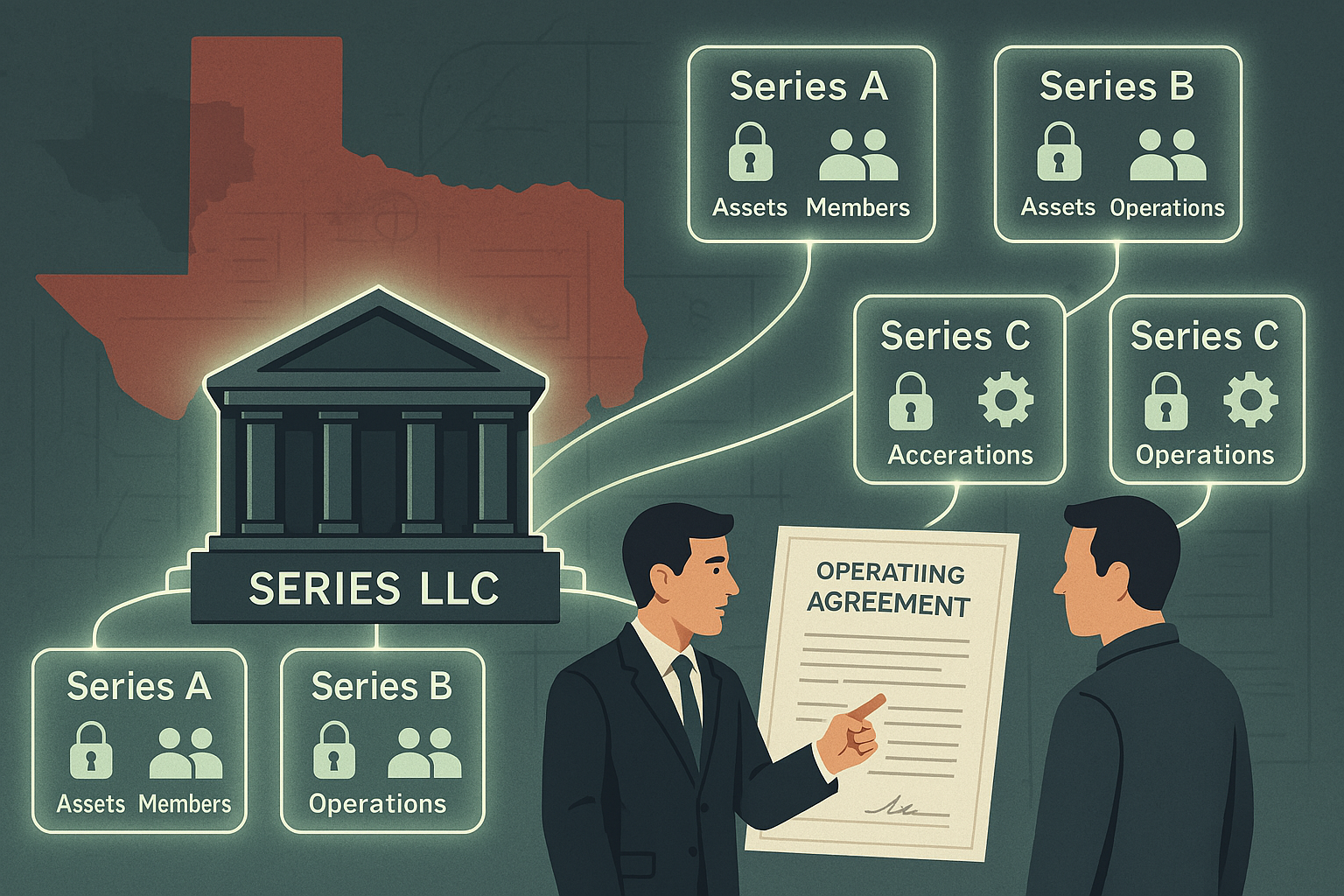

A Series LLC is a specialized form of the Limited Liability Company structure in which one parent company (or master LLC) can create multiple bespoke series, each with its own assets, liabilities, and members. Although each series functions independently, they all fall under the umbrella of the parent LLC. This unique structure allows startups and burgeoning businesses to manage different ventures without the risk of one series affecting the others legally or financially.

Key Advantages:

- Liability Protection: Each series enjoys its own liability shield. If one series faces legal action or debt, the assets of the other series are protected. As an analogy, think of this structure as having several separate safety nets under a decathlon of business operations – even if one net fails, others remain intact.

- Cost Efficiency: With only one master LLC required to deal with most of the filing and regulatory fees, a Series LLC can be more cost-effective than forming multiple traditional LLCs.

- Operational Flexibility: Each series can have its own tailored operating agreement, member structure, and management setup. This flexibility is especially beneficial for businesses that want to segment operations for strategic, tax, or risk management reasons.

To gain a comprehensive understanding of the Series LLC structure, resources like Nolo and CorpNet are invaluable.

3. Why Choose a Series LLC in Texas?

Texas has consistently earned accolades for its pro-business environment. For example, Texas has been ranked as the top state for business for 20 consecutive years, thanks in part to no state income taxes, robust infrastructure, and a growing, educated workforce. This encouraging landscape makes Texas an ideal place to implement innovative business structures such as a Series LLC.

Some of the specific benefits of choosing a Series LLC in Texas include:

- Pro-Business Climate: Texas is known for its supportive regulatory environment and low corporate taxes. These factors reduce overhead costs and make it easier to scale operations.

- Regulatory Advantages: Texas law clearly permits the formation and operation of Series LLCs, providing businesses with the certainty needed to segregate assets and liabilities.

- Benefits for Startups: By structuring a venture as a Series LLC, startups can segregate risk and segregate different business lines, protecting the overall enterprise from localized liabilities.

For further insights on why Texas is a great state for business, refer to reputable sources like the Office of the Texas Governor and Business in Texas.

4. Step-by-Step Guide to Setting Up a Series LLC in Texas

Step 1: Understand Texas Requirements

Before diving into the formation process, it’s crucial to understand Texas’ legal framework regarding Series LLCs:

- Eligibility: Verify that your business activities qualify under a Series LLC structure. Not every venture may benefit from or be eligible for this formation.

- State Statutes: Familiarize yourself with the relevant Texas statutes and requirements. The Texas Secretary of State’s website is a good starting point for this research.

Step 2: Choose a Name

Your Series LLC’s name must comply with Texas naming conventions. It should be unique and include an LLC designator. Some states require explicit language indicating that the entity is a Series LLC. Be sure to:

- Check name availability through the Texas Secretary of State’s database.

- Adhere to the state’s naming guidelines to avoid future complications.

Step 3: Prepare and File the Certificate of Formation

This is the official document that establishes your LLC. Key points include:

- Drafting Requirements: Clearly state your intent to form a Series LLC. The document should include provisions for the creation of separate series under the master LLC.

- Filing Process: Submit your Certificate of Formation to the Texas Secretary of State along with the required filing fees.

Step 4: Draft an Operating Agreement

An operating agreement is the backbone of your Series LLC. It outlines how the master LLC and its individual series will be governed, detailing:

- The management structure and rights of members

- Asset and liability segregation between series

- Internal procedures for adding or removing series, members, and changes in operations

This document is critical as it can prevent legal disputes and establish operational norms. Consider engaging a lawyer to ensure the operating agreement is robust and compliant with Texas law.

Step 5: Maintain Separate Records for Each Series

To maintain the liability protection benefits of your Series LLC, segregate the records and bank accounts for each series. This is necessary because:

- It clearly demonstrates operational independence between the series.

- It upholds the legal separation required by the state and can protect assets in case of legal disputes.

Step 6: Comply with Ongoing Requirements

After formation, ensure that your Series LLC remains in good standing by:

- Filing annual reports and other required documents with the Texas Secretary of State.

- Updating records and operating agreements as your business evolves.

- Monitoring any changes in state regulations that may affect your Series LLC structure.

5. The Pivotal Role of a Lawyer in the Series LLC Formation Process

While setting up a Series LLC might seem straightforward, the legal intricacies could be overwhelming without professional guidance. Attorneys specialized in business formations can add significant value, ensuring that your LLC is structured to maximize legal protections and operational efficiency. Here’s how they can help:

Legal Consultation

A lawyer can assess your specific business needs and determine if a Series LLC is the right structure for you. They provide clarity on:

- Texas-specific laws and regulatory requirements

- The potential risks and benefits based on your business model

Drafting and Reviewing Agreements

Legal professionals are adept at drafting an operating agreement that delineates the governance of each series and protects your interests. They ensure that:

- The operating agreement robustly separates the liabilities of each series.

- All documentation is compliant with Texas law to minimize the risk of legal disputes.

Compliance and Regulatory Guidance

An experienced lawyer will help you with ongoing compliance. They can:

- Ensure that all filings are current with state authorities

- Advise you on the necessary updates to maintain the legal benefits of the LLC structure, especially as state laws evolve

Strategic Planning and Risk Management

Lawyers also offer strategic insights on aspects like asset segregation, exit strategies, and business expansion, ensuring that your Series LLC remains a viable and legally protected entity over the long term.

6. Best Practices for Startups and Businesses with a Series LLC

For startups and growing businesses considering a Series LLC, here are some best practices to ensure success:

- Documentation: Maintain clear and detailed records for each series. Clear segregation of assets and liabilities is paramount to protecting your business interests.

- Regular Updates: Constantly review and update operating agreements to reflect changes in your business operations, membership, or even changes in the law.

- Professional Guidance: Engage legal and accounting professionals who have expertise in Series LLC structures. Their ongoing support can help you navigate potential pitfalls.

- Monitoring Regulatory Changes: Stay informed about changes in Texas laws and industry trends that might affect your business structure. This proactive approach ensures your LLC remains compliant and optimally structured.

7. The Strategic Advantages of a Series LLC in Texas

Setting up a Series LLC in Texas is more than just a legal maneuver—it’s a strategic decision designed to foster innovation, manage risks, and boost operational flexibility. For startups and expanding businesses, the ability to compartmentalize operations while enjoying the benefits of limited liability is a compelling proposition. However, the complexities of formation and ongoing compliance cannot be understated.

To recap: the key takeaways include:

- A Series LLC allows segregation of assets and liabilities among multiple series under one master LLC.

- Texas offers a favorable business environment with clear guidelines for Series LLC formation.

- Every step, from choosing a name to filing the Certificate of Formation, requires attention to detail.

- Maintaining separate records and up-to-date operating agreements are critical for safeguarding liability protections.

- Consulting with a knowledgeable lawyer can streamline the formation process and help manage ongoing compliance and strategic planning.

For entrepreneurs seeking to innovate while minimizing risks, forming a Series LLC in Texas represents a forward-thinking approach. With the right legal and regulatory guidance, you can structure your business to take full advantage of Texas’ pro-business climate while safeguarding your ventures from unforeseen liabilities.

If you're ready to explore the possibilities of a Series LLC in Texas or need further clarification on the legal subtleties involved, consulting with experienced legal professionals and utilizing authoritative resources such as those provided by the Texas Secretary of State is highly recommended. Building your business on a strong legal foundation sets the stage for long-term success.