4-Year Vesting with a 1-Year Cliff: A Practical Guide for Startup Founders and Early Employees

Equity is often the biggest part of startup compensation — and one of the main tools for aligning founders, early employees, and investors. But vesting mechanics (especially cliffs) are easy to misunderstand, even for experienced operators. When expectations don’t match the documents, it can lead to disputes, awkward departures, and diligence headaches in a financing or acquisition. This practical guide is for startup founders, early employees, and in-house counsel / People Ops who need a clear, shared understanding of how 4-year vesting with a 1-year cliff works. We’ll walk through concrete examples, termination outcomes, and drafting/communication tips.

TL;DR: How 4/1 Vesting Works in 60 Seconds

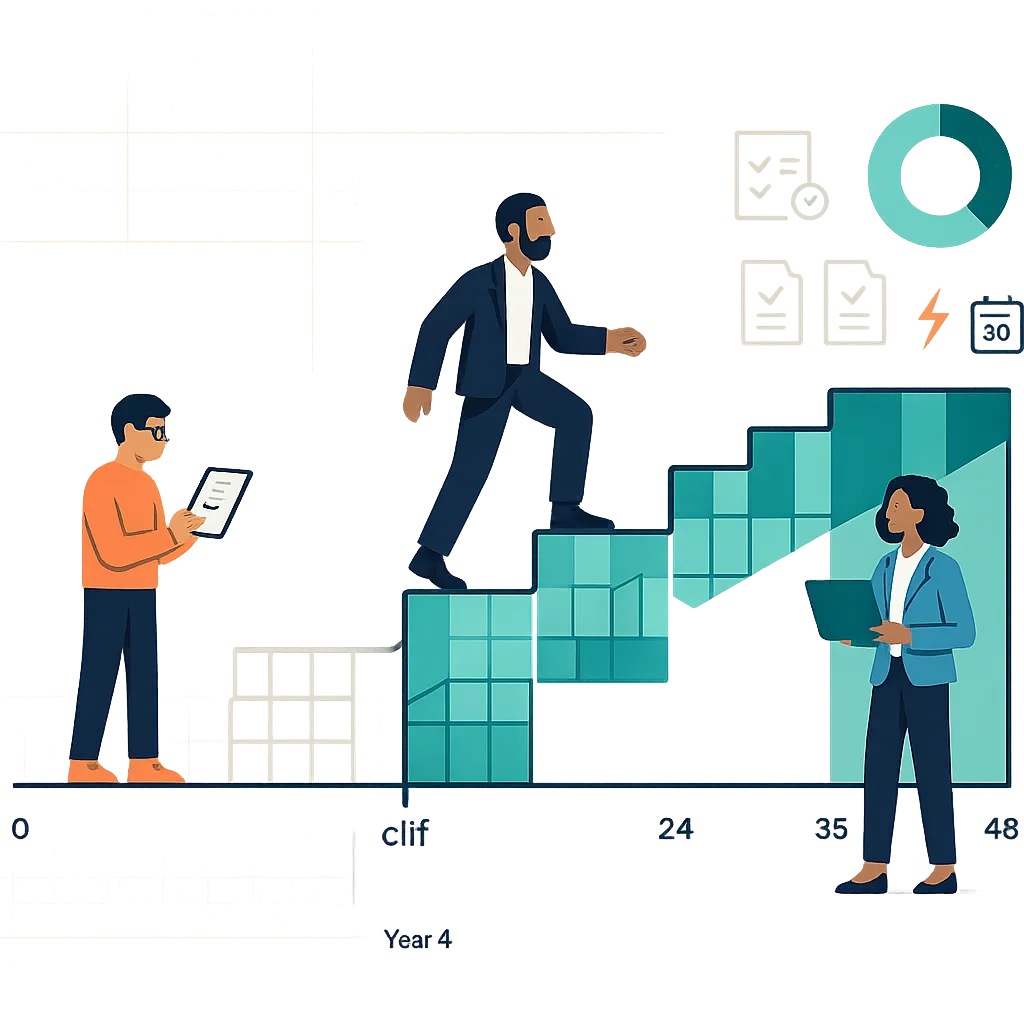

Definition: “4-year vesting with a 1-year cliff” means you earn equity over 48 months, but nothing vests until month 12, when a lump portion vests; the remainder typically vests monthly thereafter.

- Who gets it: commonly founders (via restricted stock/reverse vesting) and key employees (via stock options).

- At the cliff: usually 25% vests at month 12; after that, the remaining 75% vests over the next 36 months.

- Key decisions: monthly vs quarterly vesting after the cliff; whether any acceleration applies (single/double trigger); and for restricted stock, whether an 83(b) election is needed (and the 30-day deadline).

- Reality check: coordinate the final terms with legal and tax advisors so the plan, grant documents, and employment terms all match.

Understand the Basics of 4-Year Vesting with a 1-Year Cliff

Vesting is how you “earn” equity over time. If you leave before your equity vests, you typically lose the unvested portion (and with restricted stock, you may have to sell it back to the company at cost). The big distinction is:

- Stock options: you earn the right to buy shares later at a set strike price. Vesting controls when you can exercise.

- Restricted stock / founder stock: shares are issued up front but subject to a repurchase right that falls away as shares vest (“reverse vesting”).

A 4-year schedule usually means 48 months of service to become fully vested. A 1-year cliff means 0% vests before month 12; at month 12, a chunk (often 25%) vests at once. The cliff exists to avoid granting meaningful equity to someone who leaves quickly.

Standard timeline: grant date → month 12 cliff → monthly (or quarterly) vesting until month 48. Example: 48,000 shares/units, 4 years, 1-year cliff, then 1/48 per month (often implemented as 25% at month 12, then 1/48 of the total each month thereafter).

Founder example: each co-founder receives 2,400,000 restricted shares. At month 12, 600,000 vest (25%). After that, the remaining 1,800,000 typically vest over 36 months (about 50,000/month). Operationally, this is what keeps a departing co-founder from walking away with “dead equity,” and it’s usually documented in a stock restriction agreement with a company repurchase right.

Employee example: an early employee receives 48,000 options. At month 12, 12,000 options vest; then ~1,000/month vest thereafter. Remember: vesting does not mean “you own shares” — it means you can exercise (buy) vested options, subject to plan terms and (if you leave) a post-termination exercise window.

See Exactly What Happens at the Cliff and on Termination

Before the 1-year cliff: if service ends before 12 months, typically nothing vests. Example: an employee leaves at month 10 → 0 vested shares/options. Operationally, the cliff protects the cap table from “dead equity,” but it also creates emotional risk — say it plainly in offer conversations so no one expects partial vesting at month 6.

At and after the 1-year cliff: in a standard 4/1 schedule, the first 12 months’ worth vests all at once on the 12-month anniversary (often 25%). For a 48,000 grant with monthly vesting thereafter:

- Month 12: 12,000 vested

- Month 18: 18,000 vested

- Month 30: 30,000 vested

- Month 48: 48,000 vested (fully vested)

At termination, most plans stop vesting immediately. Whether partial months vest pro rata (or are rounded down) is a drafting choice — don’t assume.

Scenarios to plan for: voluntary resignation after the cliff (e.g., leaving at month 18 means 18,000 vested / 30,000 unvested forfeited). For options, the key additional issue is the post-termination exercise window (often 90 days for ISOs), after which even vested options can expire. For founders, termination can overlap with board removal/control dynamics — make sure founder reverse-vesting documents match governance realities.

Drafting choices that change outcomes: monthly vs quarterly vesting, treatment of partial months, and ensuring the offer letter, grant notice, and equity plan documents all describe the same schedule.

Use Acceleration and Change-of-Control Clauses Wisely

Acceleration is a provision that causes some (or all) of the remaining unvested equity to vest earlier than the normal schedule — often tied to an acquisition and/or a termination event. It matters in a 4/1 schedule because a large portion of equity may still be unvested at the time of a sale, and the question becomes: what keeps key people motivated after the deal closes?

Single-trigger acceleration means vesting speeds up automatically upon a change of control (the “single trigger”). Double-trigger means you need two events — typically (1) a change of control and (2) a qualifying termination (without cause) or “good reason” resignation within a defined window.

Example at year 2 of a 4/1 schedule (50% vested, 50% unvested):

- No acceleration: you keep vesting on the original schedule (if you stay).

- Single-trigger 50% of unvested: another 25% vests at closing (often disliked by acquirers because it reduces retention leverage).

- Double-trigger: typically no extra vesting at closing; acceleration only happens if you’re terminated or forced out post-deal.

Founder double-trigger example: 2,400,000 restricted shares on 4/1. At the 2-year mark: 1,200,000 vested, 1,200,000 unvested. If the founder has 50% double-trigger acceleration and is terminated without cause within 12 months after the acquisition, then 600,000 of the unvested shares accelerate (for total vested of 1,800,000).

Illustrative clause skeleton (not legal advice): “If [Change of Control] occurs and within [12 months] [Participant] experiences [Termination Without Cause or Good Reason], then [50%] of the then-unvested [shares/options] shall immediately vest.” Key levers are the percentage, how “change of control” is defined, and what qualifies as “good reason.”

Handle Tax and 83(b) Elections the Right Way

An 83(b) election is a US tax filing that lets someone receiving restricted stock choose to be taxed up front (based on the stock’s value at grant) instead of being taxed as the shares vest. It’s most relevant for founder stock (and occasionally early employee restricted stock) that is issued immediately but subject to repurchase/forfeiture under a 4/1 vesting schedule.

It usually does not apply to unexercised stock options (ISOs/NSOs) because there typically isn’t stock issued yet. Options have their own tax rules that kick in at exercise and/or sale.

Timing matters: the 83(b) election must generally be filed with the IRS within 30 days of the stock grant (miss the window and you generally can’t fix it later).

- Confirm the equity type (restricted stock) and the grant date.

- Prepare and sign the 83(b) form.

- Mail to the IRS within 30 days and keep proof of mailing.

- Provide a copy to the company and retain a personal copy.

Why it matters: if a founder forgets to file and the company’s value increases, the founder may recognize ordinary income as shares vest (potentially at much higher valuations). If filed on time when value is low, the tax impact at vesting can be dramatically reduced — though facts vary.

Document alignment: the vesting and company repurchase right live in the stock restriction agreement, which is the same document packet where companies often include an 83(b) reminder. This section is general information, not tax advice — founders and employees should consult a qualified tax professional.

Draft Vesting Terms and Communicate Them Clearly

Most vesting problems aren’t “math problems” — they’re document mismatch and communication problems. Standardize the terms and make sure every document tells the same story.

Core 4/1 terms to specify:

- Grant date and total [shares/options].

- 4-year vesting term and 1-year cliff (what vests at month 12).

- Vesting interval after the cliff (monthly vs quarterly).

- Termination treatment (stop date; for-cause vs without-cause treatment; repurchase right for restricted stock).

- Acceleration terms and the change-of-control definition (if any).

These terms should appear consistently across the equity plan, grant notice, option agreement or stock restriction agreement, and any offer letter / employment or consulting agreement references.

Illustrative vesting clause skeleton (simplified): “Subject to [Company]’s equity plan, [#] [shares/options] shall vest over four (4) years starting on [Start Date], with 25% vesting on the one-year anniversary and the remainder vesting in equal [monthly] installments thereafter, subject to continuous service.”

Not one-size-fits-all — real clauses must align with your plan, jurisdiction, and tax posture.

How to explain it to candidates: “If you leave before 12 months, you vest 0. On your 1-year anniversary, you vest 25% all at once; after that, you vest monthly.” Put a simple timeline/table in the offer packet and have the candidate acknowledge the cliff in writing to avoid the common “I thought I earned something at month 6” misunderstanding.

Process tip: keep a single source of truth for vesting (cap table software or a controlled spreadsheet), send a cliff reminder at month 11, and reconcile HRIS/payroll dates against equity records regularly.

Avoid Common Vesting Mistakes That Hurt Founders and Teams

- Mistake 1: No vesting (or mismatched vesting) among founders. Investors hate “dead equity” because it misaligns incentives if a founder leaves early. Better practice: put all founders on market-standard reverse vesting and document any deviations explicitly.

- Mistake 2: Burying the cliff. People frequently assume they’ll earn something before month 12 and feel blindsided when they don’t. Better practice: put the cliff in bold in the offer packet and confirm understanding in writing.

- Mistake 3: Inconsistent documents. Example: offer letter says “4-year vesting,” but the grant notice or plan uses a different cliff or quarterly vesting. Better practice: use vetted templates and make sure the plan, notice, and agreement match before issuing grants.

- Mistake 4: Missing 83(b) logistics for founder stock. A missed 30-day filing can create painful tax consequences later. Better practice: a founder onboarding checklist that includes an 83(b) reminder and tax-advisor referral.

- Mistake 5: Over-aggressive acceleration. Full single-trigger acceleration for all founders can spook acquirers and investors because it reduces retention. Better practice: thoughtful, targeted acceleration (often double-trigger) for a limited set of key people.

For related background, see Promise Legal’s resources on splitting startup equity and core contract templates (helpful when syncing offer letters and employment terms with equity documents).

Actionable Next Steps

- Inventory your grants: pull every founder, employee, and advisor grant and confirm the vesting schedule is clearly documented (plan + notice + agreement all match).

- Standardize your default: decide if your company’s baseline is 4 years / 1-year cliff with monthly vesting thereafter, then update templates and offer packet language.

- Do a “document sync” review: have counsel sanity-check your equity incentive plan, stock restriction/option agreements, and offer letters for consistency and enforceability.

- Operationalize 83(b): if you issue restricted stock, implement an onboarding checklist that includes an 83(b) reminder and tax-advisor referral (without giving personalized tax advice).

- Set an acceleration policy: define who is eligible, what percentage, and whether it’s single- or double-trigger, then document it consistently.

- Clean up tracking: make sure cap table software (or a controlled spreadsheet) tracks vesting, terminations, and post-termination exercise windows accurately.

If you want help designing founder/team vesting, drafting or revising equity documents, or preparing for investor or acquirer diligence, Promise Legal can support a structured vesting and equity clean-up process.

Disclaimer: This article provides general information and is not legal or tax advice. Consult qualified counsel and tax professionals for advice tailored to your situation and jurisdiction.